As Bitcoin hits fresh all time highs and we are starting to see renewed mainstream interest in crypto, I'd like to reflect on some of the important long-term trends that I'm paying attention to.

Increased Institutional Adoption

Fidelity Investments has observed increased interest from hedge funds, ultra high net worth individuals, and family offices, and the firm's chief strategist is managing a Bitcoin Index Fund. Their research group has published an investment thesis on Bitcoin as an aspirational store of value system along with a survey of institutional investors showing "greater interest in and acceptance of digital assets as a new investable asset class."

ARK Invest's CEO Cathy Wood has observed institutions gradually increasing their cryptocurrency exposure from a half percent allocation to around five percent. ARK has published two comprehensive white papers on Bitcoin as a novel economic institution, and as an investment.

Computer software company Microstrategy added $425 million worth of BTC to its corporate treasury, and payments giant Square purchased $50M worth of BTC. There are also signs of increased institutional interest in Ethereum, as Grayscale investments is experiencing a sharp increase in demand for their publicly quoted Ethereum investment vehicle.

Demand for Decentralized Finance

Decentralized Finance (DeFi) refers to an ecosystem of decentralized protocols and applications that allows users to engage in digital payments, trade cryptoassets, borrow and lend money, and earn interest on deposits by relying on smart contracts instead of centralized financial intermediaries. DeFi users also have access to advanced financial infrastructure such as derivatives/options trading, synthetic assets, and investment fund management software.

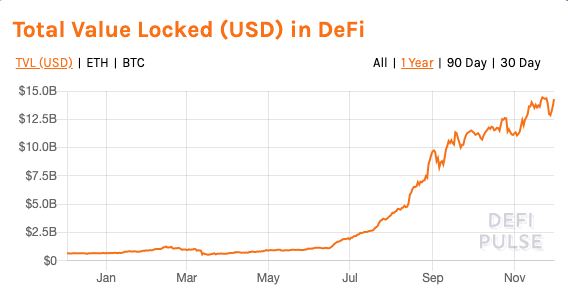

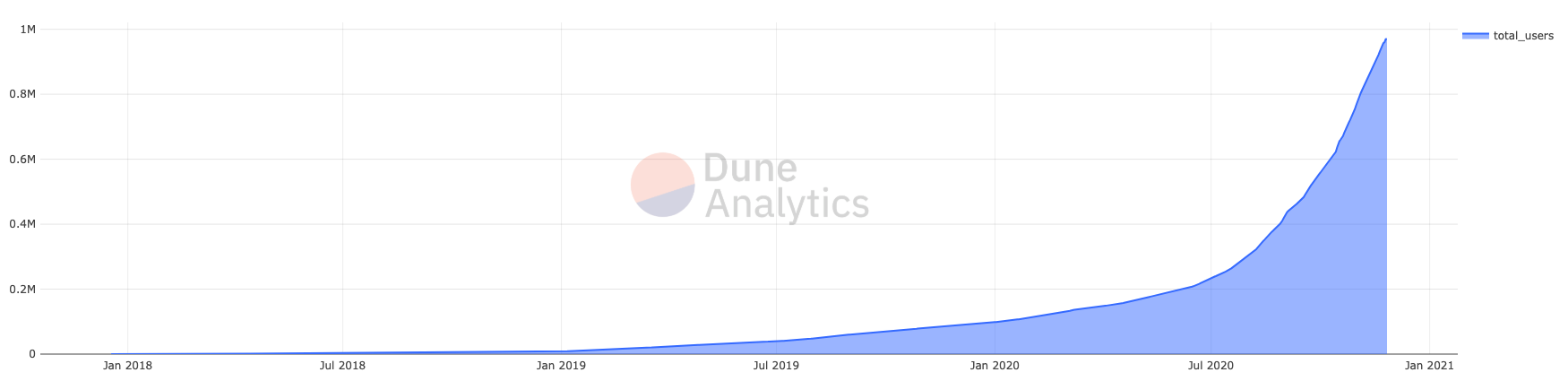

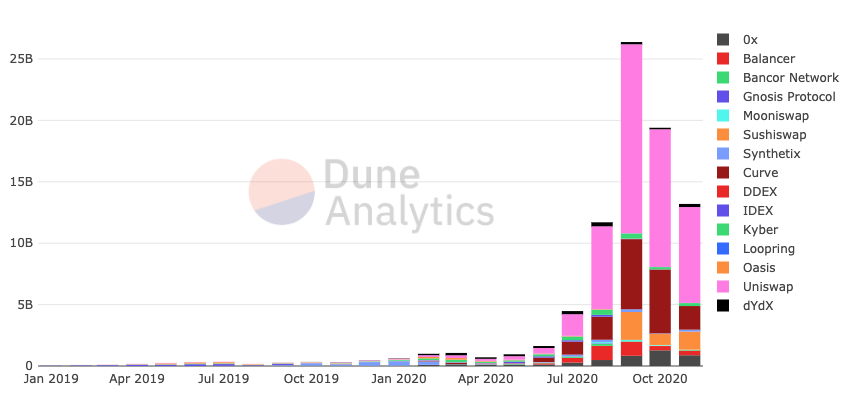

The total value locked in DeFi has grown from $690 million to ~$14 billion over the course of this year, and the number of DeFi users has grown from ~100,000 to ~984,360. Decentralized exchanges have seen a surge in activity while decentralized prediction markets like Augur, Omen, and Polymarket are also gaining traction.

New Markets for NFTs

NFTs, or "Non-Fungible Tokens," are one-of-a-kind tokens that represent a unique good or asset. They’ve been called “crypto collectibles” because, much like trading cards, NFTs can be bought and sold by collectors. -Foundation

Developers and creators are collaborating to unlock an entirely new design space for crypto with NFTs.

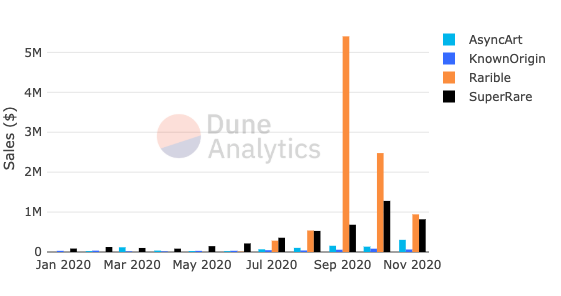

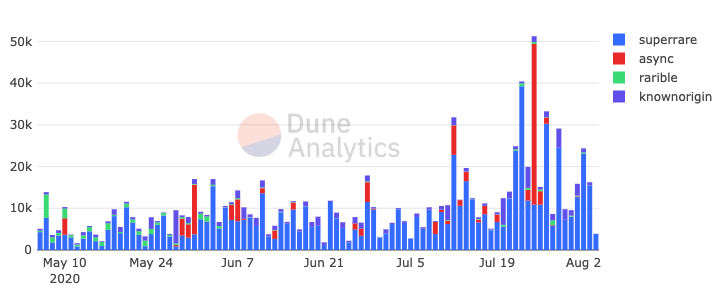

Visual artists are creating unique digital pieces which can be traded on open marketplaces such as Rarible and SuperRare, and displayed in virtual art galleries. Musicians, including grammy award winner RAC, are issuing Audio NFTs which give users access to limited physical goods and some innovative forms of digital art.

Legacy gaming companies including Atari and Ubisoft, along with cryptonative projects like Axie Infinity are using NFTs to represent video game assets. Dapper Labs' NBA Top Shot generated >$2 million from over 17,000 users in the beta of their NFT collectible game.

The number of people experimenting with NFTs is growing at a steady rate, and there are no signs of this trend slowing down.

The Dawn of Decentralized Autonomous Organizations

A DAO is an entity that lives on the internet and exists autonomously, but also heavily relies on hiring individuals to perform certain tasks that the automaton itself cannot do. – Vitalik Buterin

DAOs represent a radically new way of organizing labor and raising/allocating capital. They are a potent tool for creating organizations with more efficiency and transparency, lower barriers to entry, and more equitable ownership structures. Ralph Merkle even believes they could help us design new and improved forms of democracy.

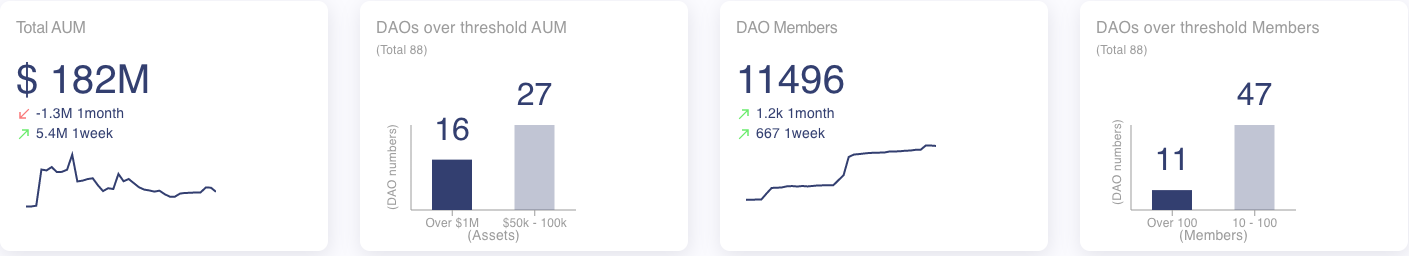

There are ~11,698 DAO members managing ~$186M worth of assets in the top 88 DAOs being tracked by DeepDAO.

While the original DAO experiment in 2016 collapsed before the potential of DAOs could be demonstrated, 2020 has witnessed a flurry of activity in the space as eager experimenters who have learned from the past are proving out the merits of the concept.

- MakerDAO manages DAI, the largest decentralized stablecoin which acts as a key pillar for the DeFi ecosystem

- Aragon and DAOHaus provide simple interfaces for creating DAOs

- MolochDAO has awarded several significant grants to projects advancing the Ethereum ecosystem

- Metacartel is funding projects that are accelerating the creation of Web3

- The LAO is a Delaware LLC primarily administered via a decentralized application that invests in early-stage Ethereum ventures

- The Melon Council DAO governs the open source Melon fund management protocol

- The Decentraland DAO owns the most important smart contracts and assets in the community owned Decentraland virtual world

- The Synthetix protocol is being governed by three separate DAOs

- The dxDAO develops, governs and grows DeFi protocols such as Omen and Mesa

- The PieDAO governs a platform for creating tokenized ETFs

Looking Ahead

During the last bull market, it was obvious that cryptoassets were bubbling primarily due to speculation and hype. While there's still plenty of that this time around, the difference is that we are now seeing significant progress in terms of adoption and the development of useful applications that are starting to find product market fit. The price action is important and exciting, but focusing on long term-trends is the best way to find the signal in all of the noise.